Sundaram Mutual's Multi Asset Allocation NFO Garners Rs. 1,890 Crores in AUM!

Mutual Fund

January 29, 2024, Mumbai: Sundaram Mutual is happy to announce the success of its newly launched Multi-Asset Allocation Fund. The fund has garnered ₹1,890 crores in AUM, with participation from 83,500+ investors. This milestone marks a significant achievement for the brand, making this its 2nd largest NFO. The NFO opened on Jan 5, 2024 and closed on Jan 19, 2024. It reopens for subscription on Feb 1, 2024.

Mr. Sunil Subramaniam, Managing Director, Sundaram Mutual expressed his enthusiasm about the fund’s positive reception stating, “The fund's introduction in the market has been met with widespread enthusiasm, attracting a diverse group of investors seeking a comprehensive and dynamic investment strategy to navigate today’s financial landscape. In this offering, we strategically blend equity, fixed income, and gold ETFs - where equity sparks capital appreciation, fixed income adds consistency, and gold acts as a resilient Shock Absorber during adverse events. I’d like to thank investors and partners for their humbling response and their trust in us. We remain committed to delivering innovative and effective investment solutions that align with your goals."

The fund will be managed by Mr. S. Bharath - Senior Fund Manager (Equity) & Head – Research, Mr. Rohit Seksaria – Fund Manager (Equity), Mr. Dwijendra Srivastava - CIO (Fixed Income) & Mr. Sandeep Agarwal - Head (Fixed Income) and Retail Business, and Arjun Nagarajan - Commodities Fund Manager, Chief Economist & Communications Manager – Investments. The benchmark chosen is the NIFTY 500 TRI (65%) + NIFTY Short Duration Debt Index (10%) + Domestic Prices of Gold (25%)*.

About Sundaram Asset Management Company:

Sundaram Asset Management Company, a significant player in the fund management space along with its subsidiaries, has assets under management of over INR 67,000 crores as on December 31, 2024. The brand has a strong retail focus with ~1.3 million active investors and 81 branches across the country. Sundaram Asset Management Company has a bouquet of sixteen equity, six hybrid and nine fixed-income funds catering to diverse investor preferences.

For more information on Sundaram Mutual and its products, please visit www.sundarammutual.com.

For Media Enquiries:

Harit S. Tank

Phone: 022 - 30100215 | Mobile: +91 98194 55607

Email: harittank@sundarammutual.com or harit.smf@gmail.com

Fund Synopsis:

Scheme Name: Sundaram Multi Asset Allocation Fund.

Scheme Type: An open-ended scheme investing in equity, debt and money market Instruments and Gold ETFs.

Investment Objective: To generate long term capital appreciation by investing in Equity & Equity related Securities, Debt & Money Market Instruments and Gold ETFs.

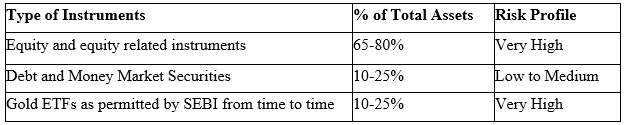

Asset Allocation:

New Fund Offer Period: The Scheme will open for subscription on January 5, 2024 and close on January 19, 2024

Benchmark: NIFTY 500 TRI (65%) + NIFTY Short Duration Debt Index (10%) + Domestic Prices of Gold (25%)*.

Fund Managers:

- Mr. Rohit Seksaria & Mr. S Bharath (Equity)

- Mr. Dwijendra Srivastava & Mr. Sandeep Agarwal (Fixed Income)

- Mr. Arjun Nagarajan (Gold ETFs)

Minimum Application Amount: For both Regular and Direct Plan: ₹100 and multiples of ₹1 thereafter per application.

SIP: Monthly: ₹100 (Min. 6 instalments), Quarterly: ₹750 (Min. 6 instalments), Weekly: ₹1000 (Min. 6 instalments)

Load Structure

Entry Load: N/A

Exit Load: If units are redeemed, withdrawn by way of SWP within 365 days from the date of allotment

- Up to 30% of the units: Nil

- More than 30% of the units: 1% of applicable net asset value

Further, exit load will be waived on intra-scheme and inter scheme switch-outs/STP.

*Spot price of MCX Gold

Riskometer

Sundaram Multi Asset Allocation Fund is suitable for investors who are seeking*

- Long term capital growth

- Equity & Equity related Securities, Debt & Money Market Instruments, Gold ETFs.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

MUTUAL FUND TOOLS & CALCULATORS

Recent News

-

Axis Mutual Fund joins ONDC Network to Expand Access to Mutual Fund Investments

Apr 18, 2025

-

RBI Monetary Policy: RBI changes policy stance and lowers rate

Apr 9, 2025

-

Reciprocal Tariffs: Casting a wider net

Apr 7, 2025

-

Axis MF: Gold and Silver Outlook

Mar 17, 2025

-

Axis AMC appoints Nandik Mallik as Head: Equity & Hybrid for its proposed SIFs

Mar 6, 2025